Let’s talk about what’s going on in markets and the economy after the recent bank failures.

Quick recap: Over the last few weeks, several banks have collapsed under the pressure of bad management, high-interest rates, portfolio losses, and a run of depositor withdrawals.

Since then, regulators, governments, and other major financial institutions have stepped in to take over troubled banks and guarantee deposits.1,2

It has also emerged that Silicon Valley Bank (the first to fall) had already been under regulatory review by the Federal Reserve for more than a year about the very issues that triggered its collapse.3

One of the possible silver linings of these failures is that other small institutions with similar problems are probably looking very hard at their books and reassessing their strategies to avoid a similar fate.

Will these bank failures trigger a recession?

I wish I had a simple answer for you. In the short term, it doesn’t look like these problems are big enough to threaten the overall economy.

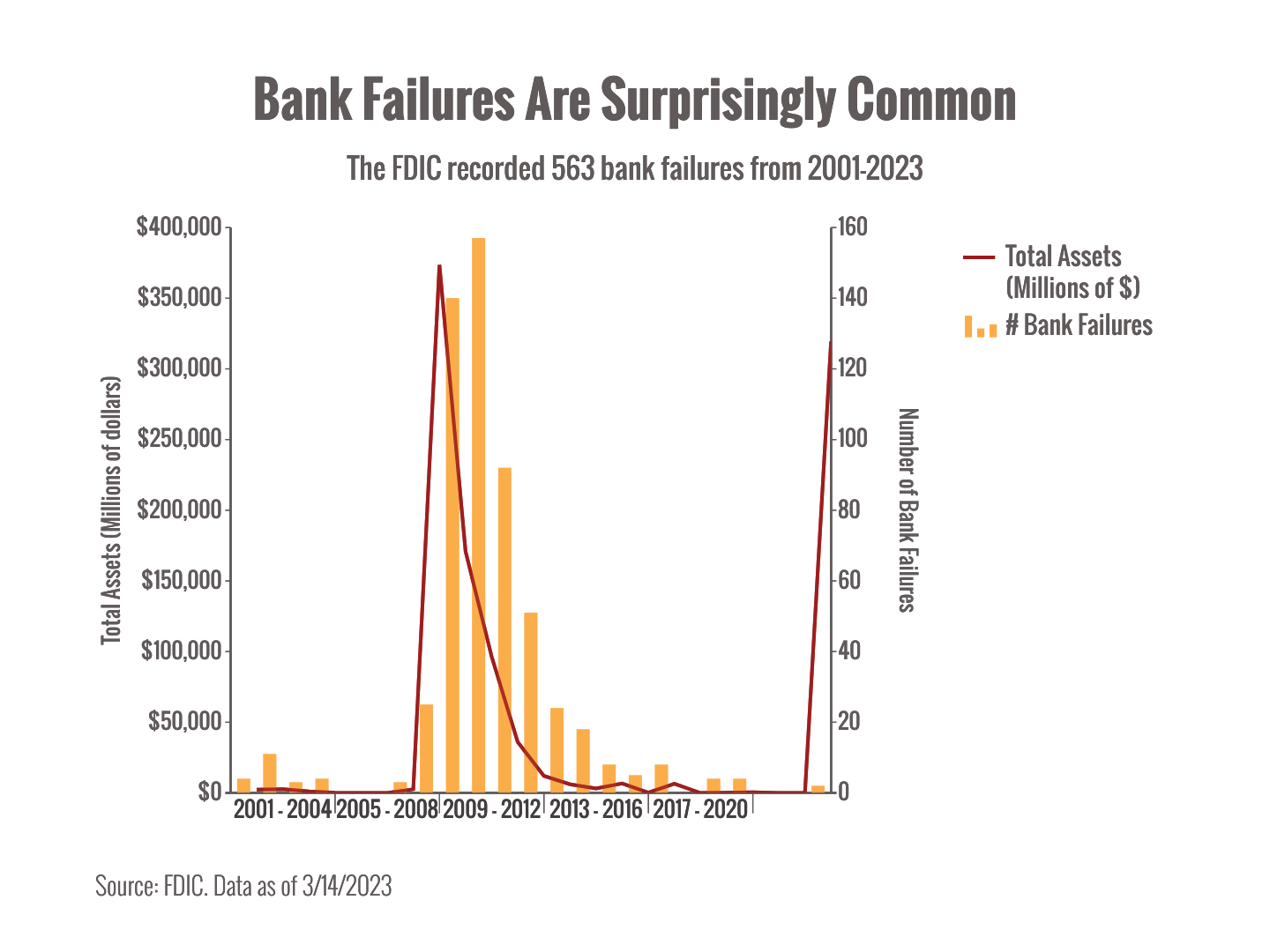

In fact, banks fail almost every year without triggering serious problems. According to the Federal Deposit Insurance Corporation, 563 banks have failed since 2001.4

However, if banks get stricter about lending (as they did after the 2008 financial crisis) and the cost of getting loans increases with higher interest rates, the end result could be slower economic activity.

If employers get leerier about hiring workers or Americans get more cautious about their spending, that could also take a bite out of the economy.

What’s happening with markets?

After giving in to fear and selling off, global markets rebounded after regulators and central banks stepped in to stabilize the situation.

The Fed hiked interest rates a quarter of a point at their most recent meeting (as expected), and indicated that they might be pausing increases later this year.

Markets reacted positively to the news, buoyed by hopes of an end to higher interest rates, but let’s not be surprised by more volatility when it comes.5

Bottom line, there’s a lot going on in the world, and markets are caught in a whipsaw of good news and bad. We’re keeping an eye on trends and will update you as needed.